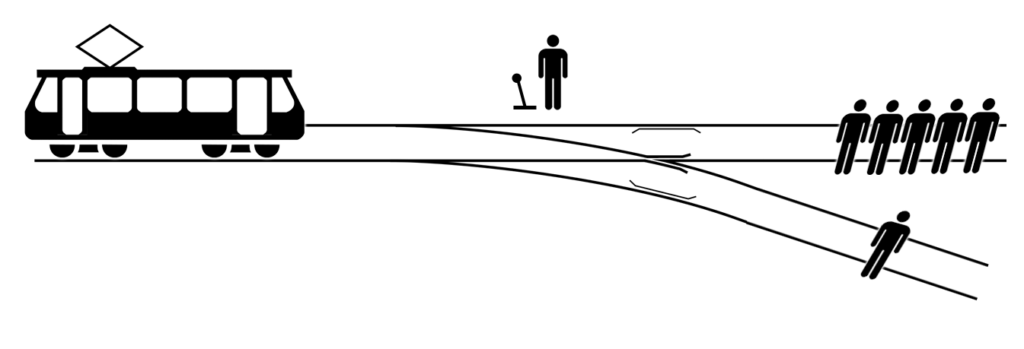

Imagine, you are standing next to train tracks and you see a train coming. There are five people tied up on the tracks, they will die if the train keeps going. But there is a lever next to you that you could pull to switch the train onto a different track. However, only one person is tied up on the other track. What do you do? Do you pull the lever and save those five people and let that one person die, or do nothing and the five people die?

It’s a hard choice. This is called the Trolley Problem, a commonly shared thought experiment in ethics.

The financial inclusion space is currently witnessing an influx of commercial players. This poses a threat to the social mission of the sector, leading to negative impacts. If we stop this to empower and enable non-traditional providers, we risk misuse of sensitive data, over-indebtedness, and other unintended consequences. The financial inclusion lever could and likely will be responsible for eroding social capital and disrupting economic equilibrium.

Financial Inclusion for Migrant Communities

I currently work with Shram Sarathi, who primarily works on the financial inclusion of vulnerable migrant communities of southern Rajasthan. These communities often struggle with erratic incomes and employment. This means that they cannot rely on a stable source of income to support their families. This can lead to immense stress and anxiety as they struggle to make ends meet, and worry about their financial future. Additionally, many people from these communities have shorter work lives and must retire earlier than others, making it difficult to save for retirement and leading to financial difficulties in their later years.

For a migrant worker, cash flow volatilities at their home location can make it challenging to plan for the future. Additionally, exclusion from formal financial institutions means that they may not have access to credit and other financial services that are essential for building a stable and secure financial future. Many people in these communities find themselves burdened with debt. This out- migration is not voluntary. It is caused by inadequate opportunities in the local economy and unfavourable conditions for large-scale agriculture.

In the last 9 months, I have seen and experienced how the work of a non-profit organization differs from that of other Micro-Finance Institutions (MFIs) in the area. At Shram Sarathi, we conduct several reviews to determine the client’s needs and wants before extending credit. It may sound simple, but there are different levels of dynamics at play. Ethical conflicts arise when we deal with money and that too with communities that are extremely vulnerable and sensitive. It is hard to ignore the fact that the lack of proper control mechanisms in other financial services institutions has contributed significantly to the build-up of unsustainable levels of debt among borrowers.

This gradually leads to over-indebtedness which results in loan defaults and in extreme cases, the borrower dies by suicide.

Challenges of a Non-Profit Financial Institution

Of the many conflicts we face, one is the challenge of providing loans to borrowers from communities where there are high numbers of loan defaulters. We must ask ourselves, where is the demand assessment in such cases. How do we actually perform in a situation like this?

It’s not easy to approve these loans. No asset has to be pledged for these loans. However, the guarantee of a friend or a relative is required, and if this person is also a debtor, it becomes risky for us to grant the loan. In such cases, it is better to give the loan to another person who is also in need. Other eligible applicants will benefit from this money in the long run.

But what happens when we have thoroughly vetted the borrower and their urgent need for the loan, and they still stop repaying after a few instalments due to circumstances we could not have foreseen. As an institution, it is our responsibility to ensure that the borrower repays the loan. Thus ensuring he/she does not become a defaulter/ delinquent payer and can continue to receive financial assistance from similar financial institutions in the future.

Also, as a non-profit organization, we need funds to assist other needy families who are slipping into poverty. The repayment of these funds by the community is one of the sources we rely on, to lend support to other similar families.

Ethical Frameworks and their application in Financial Inclusion

There are certain approaches to ethics that readers could keep in mind while going through this – Deontological ethics, consequentialist ethics, and virtue ethics are three common ways to ethical decision-making that we can keep in mind here.

Deontological ethics, also known as duty ethics, focuses on the inherent morality of an action rather than its consequences. This approach emphasizes that certain actions are inherently right or wrong, regardless of the consequences they entail. For example, one may believe that a positive outcome doesn’t justify lying. Philosopher Immanuel Kant, developed this. He believed that morality should be based on rational principles, such as the famous ‘categorical imperative’. It states that one should act only according to principles that could become universal laws.

At Shram Sarathi, it is our duty to extend credit while collecting outstanding amounts as bad debts on the spot.

Consequentialist ethics, also known as utilitarianism, evaluates the morality of an action by its consequences. This approach emphasizes the importance of maximizing overall happiness or well-being. According to consequentialist ethics, the right course of action is the one that benefits the greatest number of people. For example, you can lie to someone if it prevents greater harm. Philosopher Jeremy Bentham is one of the founders of Consequentialist ethics. He said, “The greatest happiness of the greatest number is the basis of morality and legislation”.

In our case, we must remember to give loans to those in need despite the risk of loan defaults. This means we are doing so for the greater good. However, loan defaults lead to over-indebtedness, which ultimately harms the borrower and the community.

Virtue ethics emphasizes the character of the person making the decision, rather than the specific actions themselves. This approach emphasizes the importance of developing virtuous character traits, such as honesty, courage, and compassion, rather than following a set of moral rules or calculating outcomes. According to virtue ethics, it is a matter of cultivating good habits and virtues, rather than following external rules or guidelines. Aristotle, the Greek philosopher developed virtue ethics. He believed that virtues are necessary for a prosperous human life.

When we are dealing with clients who are unable to repay their debts, a virtue ethics approach would mean that we take the time to listen to their stories and understand their problems. This requires us to show empathy and genuinely care about their well-being. This may mean going beyond the traditional duties of a lender and looking for ways to help our customers find alternative solutions. Although this may have short-term financial consequences for the company. The virtue ethics perspective recognizes the intrinsic value of showing compassion and empathy for people in difficult situations. It holds the belief that by prioritizing the welfare of customers and their families, we contribute to the common good and strengthen relationships within the community we serve.

Is there a right way?

Each ethical approach has its strengths and weaknesses. Different approaches may be more appropriate depending on the situation and context. Overall, the ethical conflicts identified in this section illustrate the complex choices that financial institutions, particularly non-profit organizations, must make when lending to vulnerable communities.

These ethical conflicts arise from systemic problems in our society. Lack of access to credit for those in need is one major issue. Only a limited number of people have access to formal credit in India. The informal sources are providing loans at exorbitant interest rates. This perpetuates the cycle of poverty and debt, and makes it difficult for individuals to break free.

In conclusion, our work also involves managing complex ethical conflicts in ways that are both compassionate and effective. We must constantly examine our actions and decisions to ensure that we are truly having a positive impact on the lives of those we serve.

Reference: Ethical theories

0 Comments