Trigger Warning: Suicide, Death, Distress

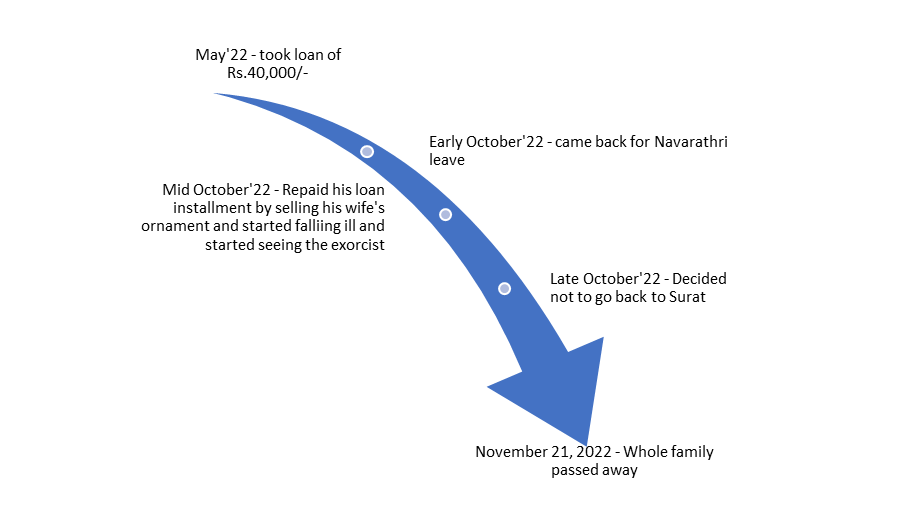

Ramesh Lal*, his wife and their four children were found dead at their home in the Udaipur district on 21st November , 2022. He was the only earning member in this six-person household. He had earlier migrated to work at a private kitchen in Surat, Ahmedabad. After Navarathri, he decided not to go outside to work and had been living at home, working odd jobs whenever he can. In his village, there was no reliable source of income for him.

According to his brother’s family, Ramesh was ill since Navaratri. They asserted that he constantly vomited blood and failed to identify the disease since he never consulted a doctor. He and his brother shared a two-wheeler. His brother was helping him in paying back the instalments on a motorcycle loan that was about to expire.

Other than that, he also had a debt of Rs. 40,000 through a JLG (Joint Liability Group). He had used this money to construct his house. The initial instalments were paid by him on time. But he was facing issues to do that since he had come back home. Ramesh had also asked his wife to sell her ornaments for Rs. 3,000 out of which he used Rs. 1,830 to pay back the instalments and the remaining for his everyday household expenses.

He was getting more frustrated by the day about his unemployment. His sickness also bothered him constantly. Considering all this, he went to a local exorcist in another village, thinking that he had bad energy inside him. Ramesh wanted the exorcist to take care of whatever problem he has so that he may resume working at a legitimate job and provide for his family.

As a part of the ritual, the exorcist asked him to sacrifice an animal. It costed him Rs. 8,000 which was borne by his wife’s family. However, his problems didn’t end. He still had to deal with his illness and unemployment.

Let’s take a look at Ramesh’s timeline in terms of what happened to him during the last 6 months.

Why did he move to Surat in the first place? Ramesh had low possibility to satisfy his family’s consumption demands back in his village due to lack of local opportunities to work. He was compelled to relocate in the quest of earning money. He believed that moving would better enable him to support his family, despite the difficulties he would face there. There is a danger that he could get into debt, fall victim to fraud, or experience sudden financial shocks in the absence of a basic understanding of loans, insurance and savings.

A what-if scenario

| Areas | With adequate financial literacy | Without financial literacy |

| Credit – loans | Informed choice regarding the necessity of loan | Persuaded by peers to take loans when they are not essential |

| Financial inclusion schemes | Benefit from the Chiranjeevi Bhima Yojana to help with illness | Ended up seeing an exorcist to address his condition |

| Savings/micro-investments | Putting some money away so that it could serve as an emergency fund when needed. | Lack of funds results in borrowing through both formal and informal channels. |

Role of finance institutions in this area

They contribute to the system in multiple ways. Micro finance institutions (MFIs), as we know them today, were pioneered by Muhammed Yunus in Bangladesh. He was later awarded a Nobel prize. In India, we can trace the roots of MFIs back to SEWA (a co-operative bank in 1972) and NABARD in 1982.

The economic growth of India is significantly influenced by this movement. It acts as a preventative measure against poverty for people who live in marginalised sections of rural and urban areas. Its objective is to assist people and communities who are struggling in obtaining greater levels of wealth creation and income security.

Businesses that are dedicated to promote equality think that each person is a valuable asset who deserves access to resources required to realise their full potential. Their main goal is to develop and execute policies as well as initiatives that can turn members of low-income communities from mere “beneficiaries” to active participants in their own development.

As a last-mile provider of financial services, MFIs and other social enterprises work at the ground level to promote financial inclusion. They serve as a link between the people and the industry. However, how far in front or behind are we? According to data from the RBI, the annual Financial Inclusion Index (FII) value for March 2022 is 56.4, up from 53.9 in March 2021, with increases seen across all sub-indices. That does really imply that we are expanding.

Also read: The Good, Bad And Ugly Of Micro-finance in Uttar Pradesh

However, we, specially MFIs, social enterprises and commercial banks need to think about the subtleties from the aforementioned incident as we proceed on our road to support the disadvantaged communities. Those who are labelled as “un-bankable”.

Only an informed customer will be able to take appropriate financial decisions, thereby engaging in measurable and productive economic activities

Even though there are effective financial inclusion schemes like Pradhan Mantri Suraksha Bima Yojana, Atal Pension Yojana, Pradhan Mantri Mudra Yojana, Sukanya Samriddhi Yojana, and so on, do the prospective recipients of these schemes understand their benefits. Do they know how it will improve their lives? Simply lending money doesn’t solve problems. Yes, it helps the families out, but it’s also important to educate the recipients on benefits and drawbacks of microloans as well as preparing them to handle unexpected financial hardships.

Do they realize that if their credit history is poor, they have little to no chance of obtaining a loan from an MFI or a bank in the future. Or how they can use the Ayushman Bharat card or the Chiranjeevi Bima Yojana to their advantage rather than turning to local moneylenders for funding their medical expenses.

All things considered, these organizations working to improve financial inclusion have a significant impact on tragedies like that of Ramesh and his family, in the future. Making people financially literate and empowering them to take control of their lives will significantly improve people’s general well-being.

*Name changed to maintain confidentiality

0 Comments