Meet Mahi Mahila Bachat Mandal, a Self Help Group of Sakhi Sangini Sangathan (a women’s federation). Women of Juni Ravalwadi slum of Bhuj, Kutch formed it in 2015. This Mahila Mandal consists of 17 members, most of whom come from financially strained households. Members joined as they saw value in the power of regular saving and having access to credit, that they otherwise cannot get. 9th of every month members of Mahi Mahila Bachat Mandal come together for their bachat meeting.

Mahila Bachat Meeting

(note: during this meeting, prayer recitation happened towards the end of the meeting due to time constraints. Prayers are mandatory to encourage discipline and harmony among the members).

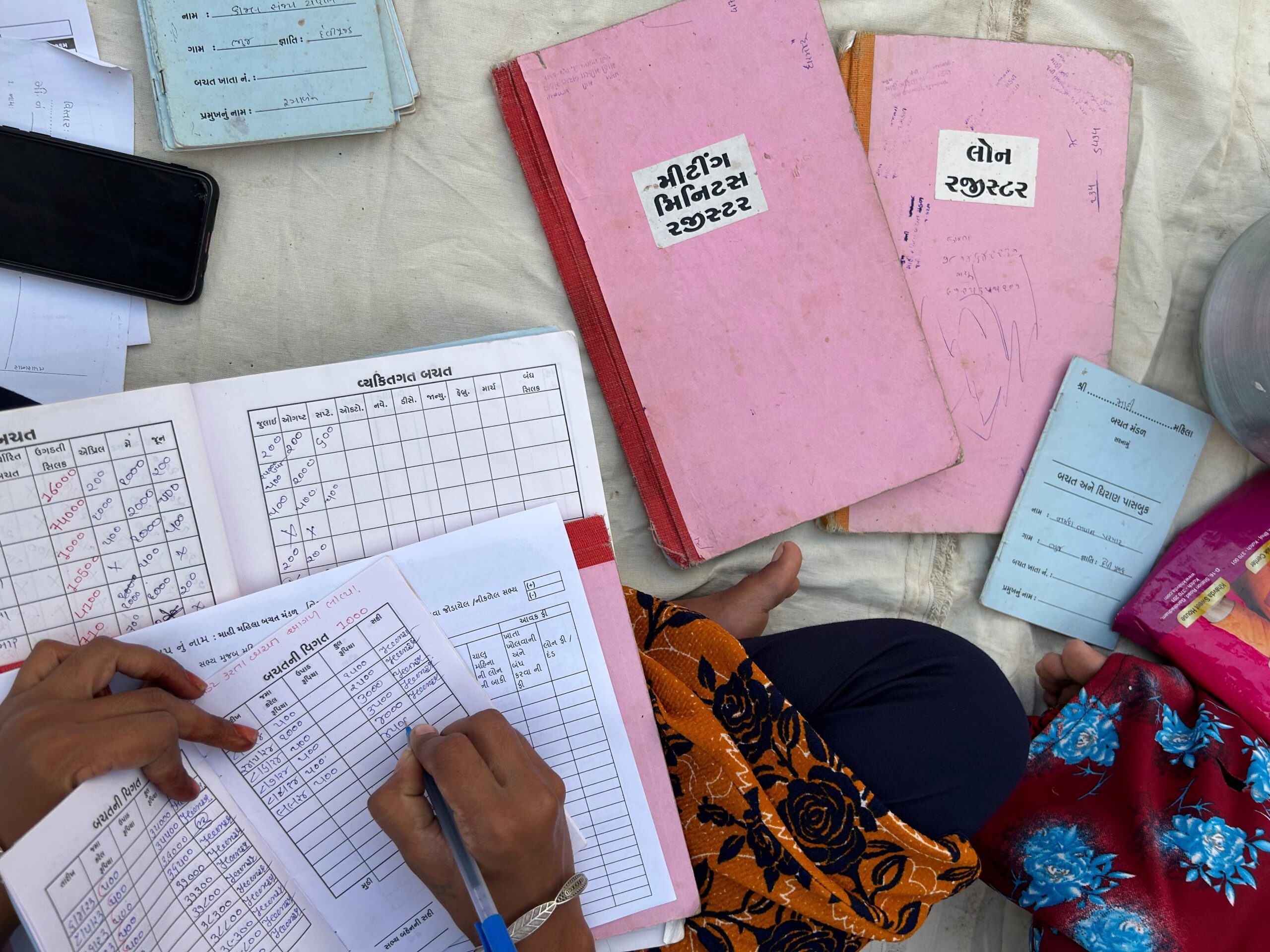

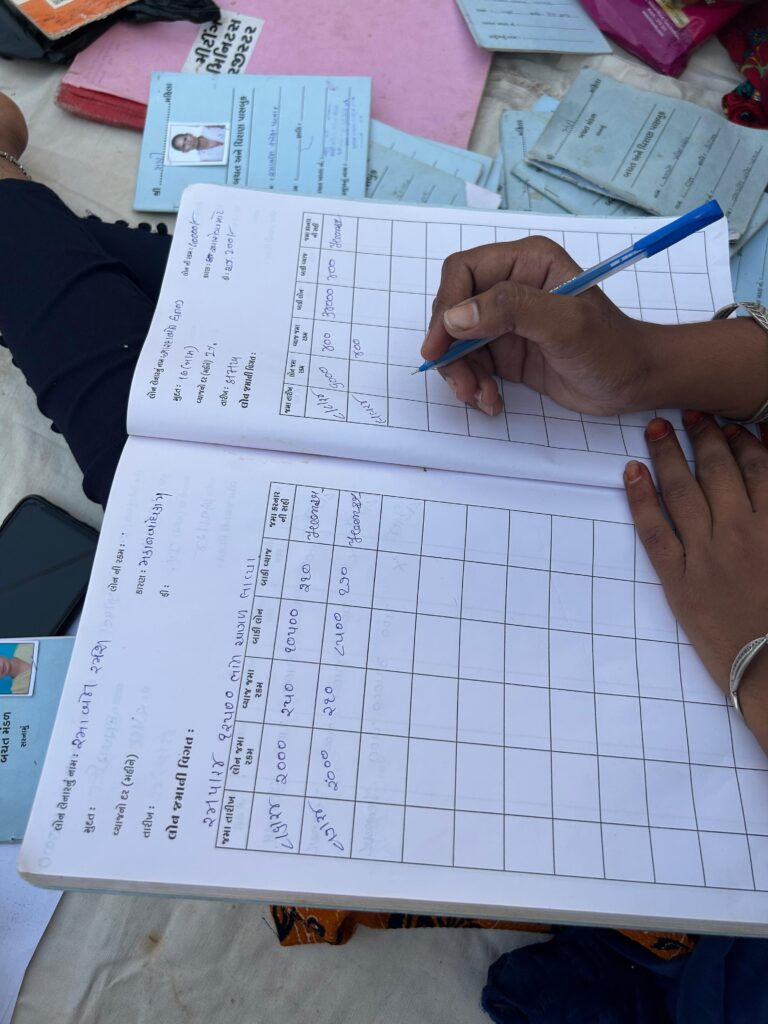

The mandal maintains financial records using individual passbooks, an avak javak (income and expenditure) sheet and a balance sheet.

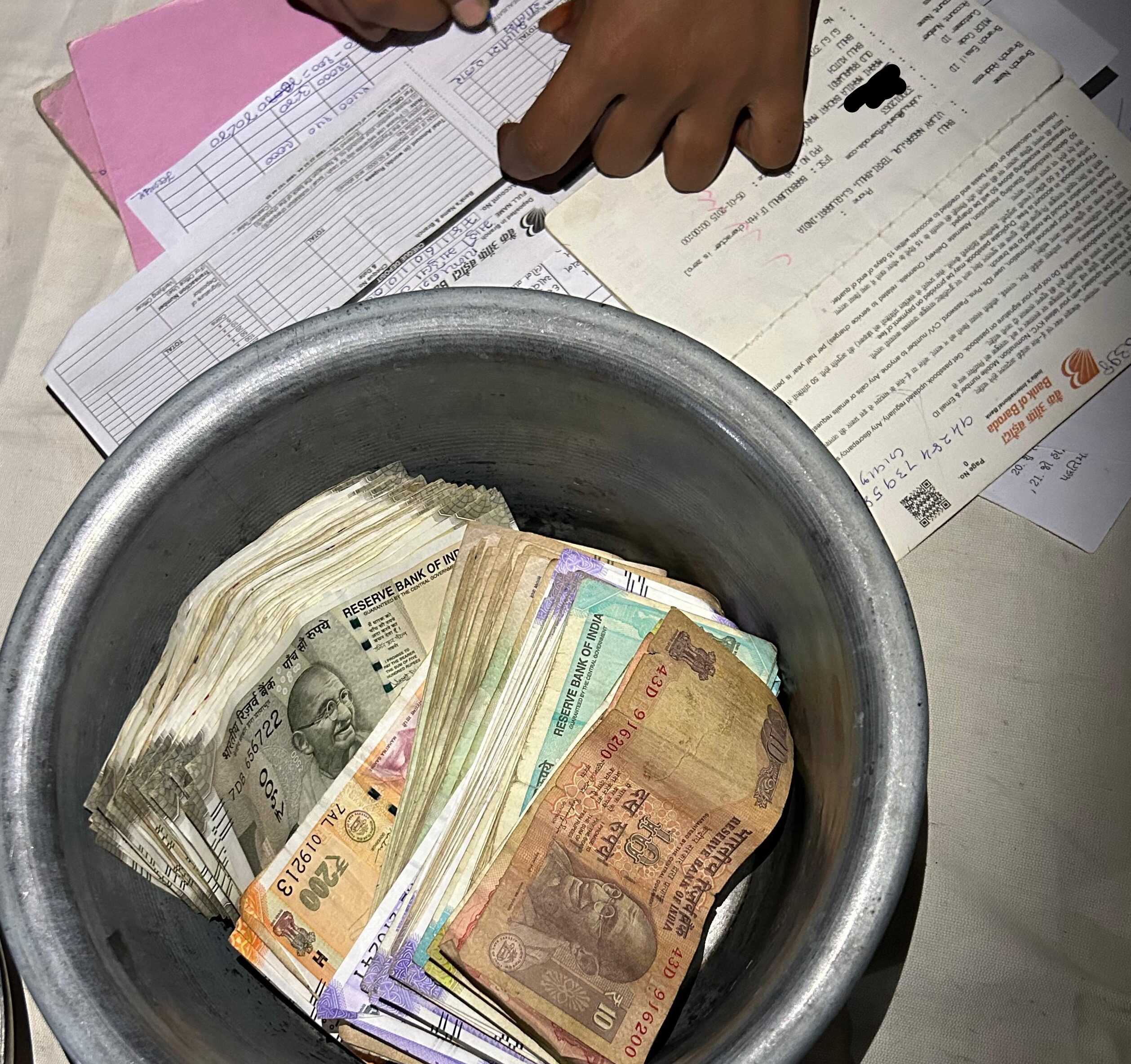

Counting Cash

This interest rate ensures a long-term sustainable income for the SHG. After three years, SHGs distribute the interest earned on their funds back to the members, ensuring a sufficient amount remains in the bank account for emergencies.

It is mandatory for each member to go to the bank for cash deposit rotationally. They implemented this rule for two reasons: first, to encourage women to familiarise themselves with the bank and its operations. Second, it establishes transparency and accountability as no single member controls the movement of money, thereby reducing chances of fraudulent activities.

Talking To Bhanuben

“A few years ago I took a loan of Rs 1 Lakh from my mandal which helped me rebuild my house,” shared Bhanuben. I had asked her if the SHG had made any difference in her life. Bhanuben’s daughter has a developmental disorder which makes her entirely dependent on her mother for care-giving.

“Due to my daughter’s illness, we often face significant medical expenses”, she added. She considers her membership in the SHG invaluable, as it provides her with timely access to loans for hospital bills. This eliminated the need to depend on unreliable financial sources during emergencies. Bhanuben’s ability to confidently apply for a loan within her SHG demonstrates the empowerment and financial security it offers its members.

Also Read: Where Collective Strength Lies

0 Comments